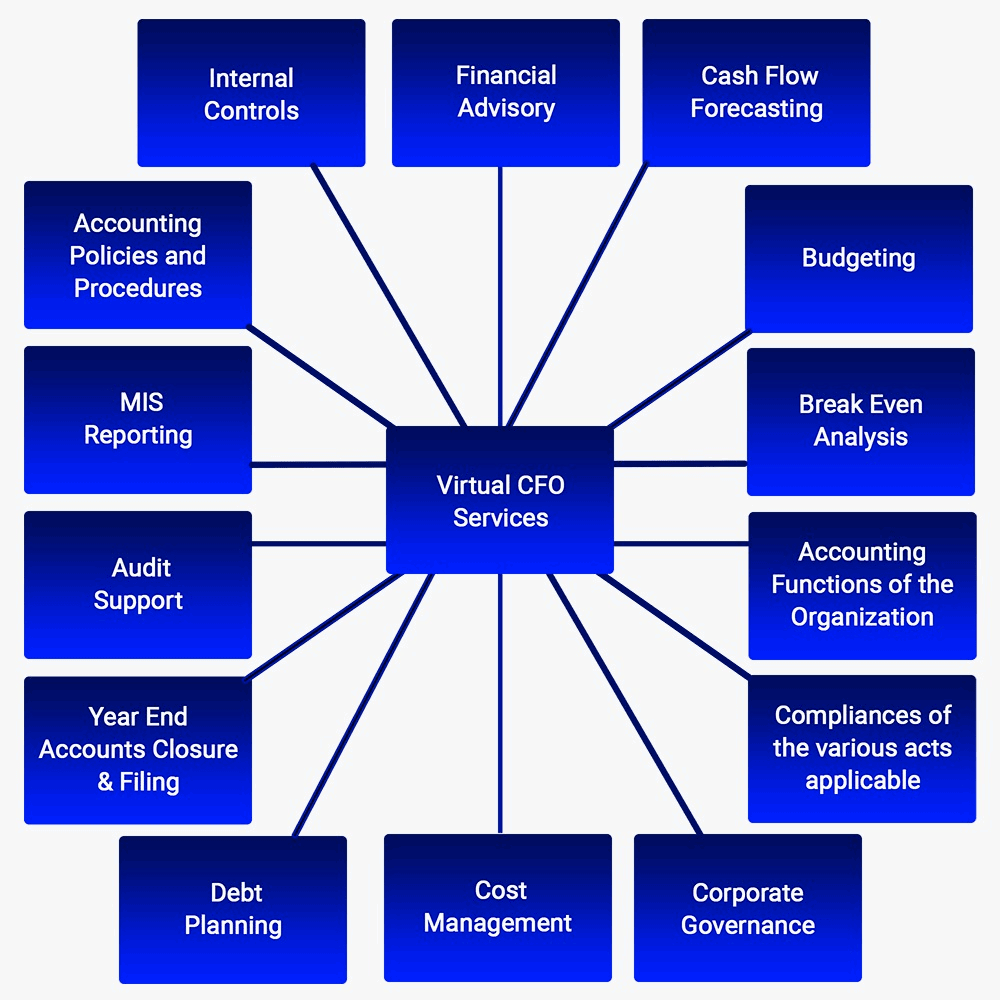

Virtual CFO Services

- Preparation and explanation of management accounts

- Cash flow projections

- Budgeting – interim and annual

- Overview of Bookkeeping and Month end closes

- Compensation designing

- Debtor and creditor management

- Structural advice

- Project management of the financial component of new ventures

- Compliance management – Corporate, Taxation and Listing laws

- Review and assessment of internal controls

- C-Level Recruitment support and guidance